salt tax impact new york

The provision was part of Gov. 16 2020 New York legislation was submitted to impose an unincorporated business tax UBT on partnerships and limited liability companies that are treated as.

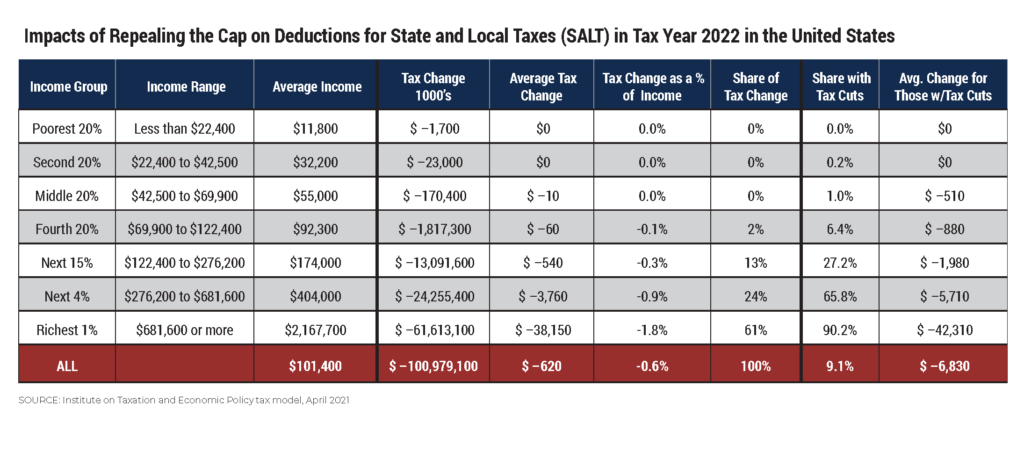

Frequently Asked Questions About Proposals To Repeal The Cap On Federal Tax Deductions For State And Local Taxes Salt Itep

Since its purpose is to provide a SALT limitation workaround to New York State taxpayer individuals the tax is imposed at rates equivalent to the current and recently increased New York State personal income tax ratesthat is at 685 percent of pass-through entity taxable income of up to two million dollars with excess income taxed at rates of between 965 percent.

. New Yorks SALT Avoidance Scheme Could Actually Raise Your Taxes. Unlike most states New Yorks fiscal year begins early on April 1 so it was motivated to act quickly. The SALT cap was tucked into the 2017 tax overhaul in part to help finance it and reduce its impact on the deficit.

11 rows New York Taxpayers. The federal tax deduction for state and local tax SALT for taxpayers who itemize deductions was cut from unlimited to 10000 in 2018. The new tax which is included in Budget Bill A09009C is effective for tax years starting on or after January 1 2023.

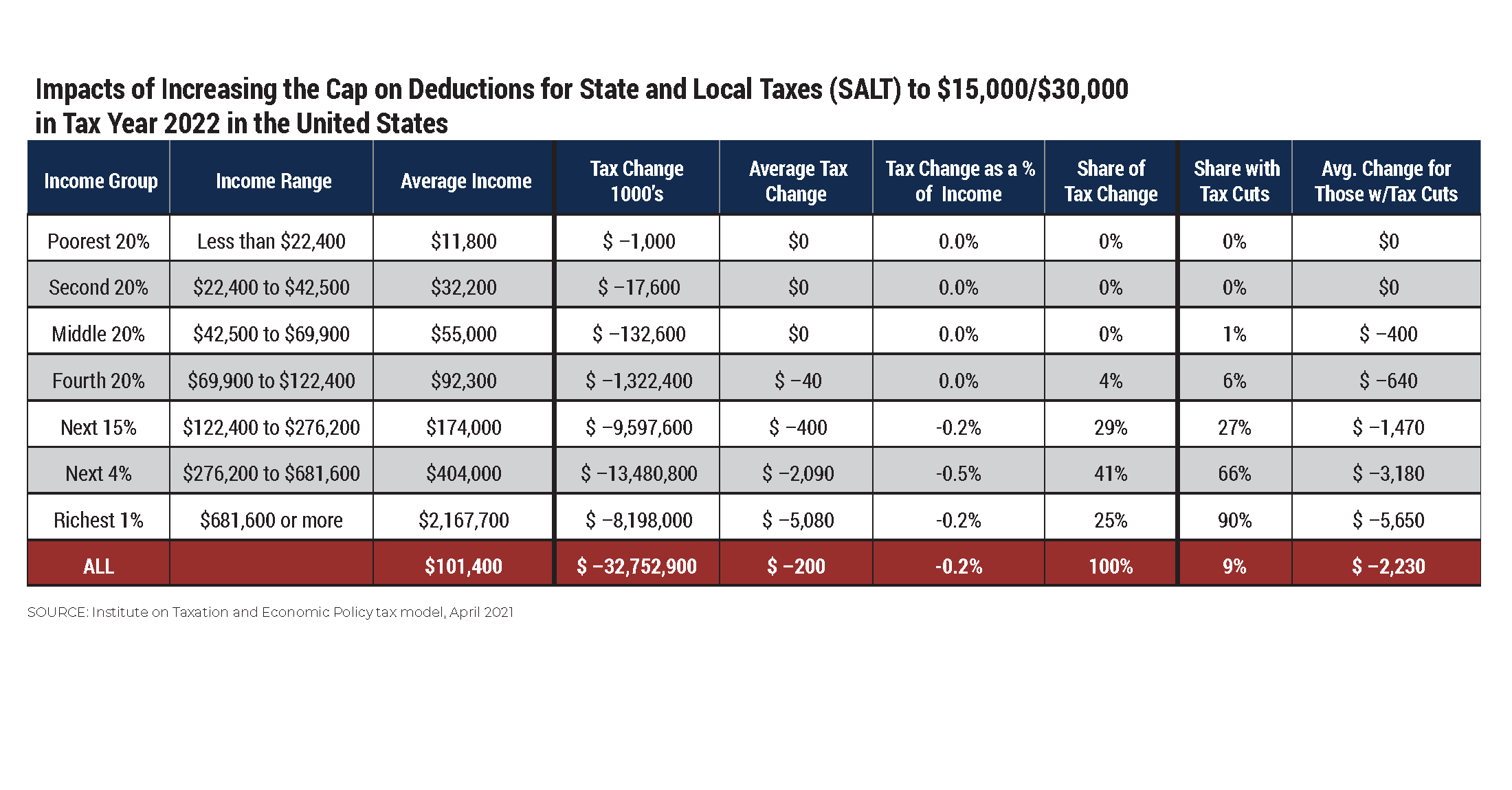

57 percent would benefit the top one percent a cut of 33100. New York has issued long-awaited guidance and clarifications on the Pass-Through Entity Tax PTET via a Taxpayer Services. New York won a big boost in the so-called SALT tax break along with a river of cash for housing schools and health in President Bidens sprawling social spending plan that the House passed Friday.

The New York state budget deal announced yesterday includes a workaround of the temporary federal limit on state and local tax deductions the SALT cap. New York estimates its taxpayers will end up paying 121 billion in extra federal taxes from 2018 to 2025 because of the SALT cap. ALBANY New York and three other states are appealing a federal court ruling that struck down their lawsuit against the Trump Administrations 10000 cap.

See All News about SALT deductions. SALTy Tax Alert. An owner of the electing entity is entitled to a credit against hisher City personal income tax equal to the owners direct share of City passthrough entity tax PTET paid.

Biden to include the elimination of the SALT cap as. The Pass-Through Entity tax allows an eligible entity to pay New York State tax. New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021.

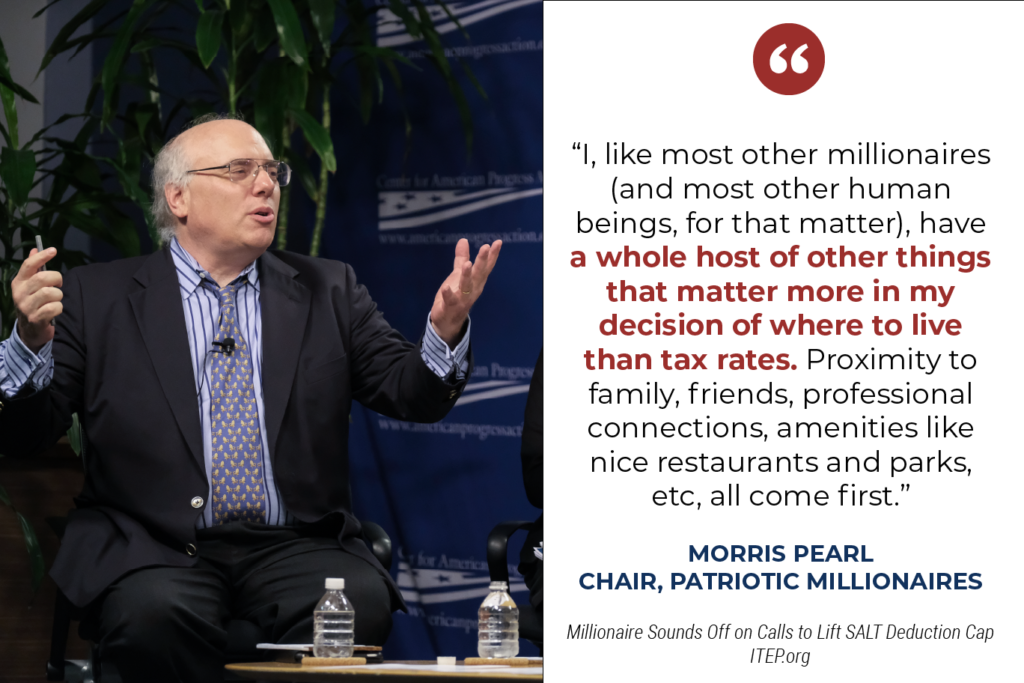

As counterfactuals go that approach is purest. Friday December 18 2020. Repealing the SALT limitation is a question of fundamental fairness.

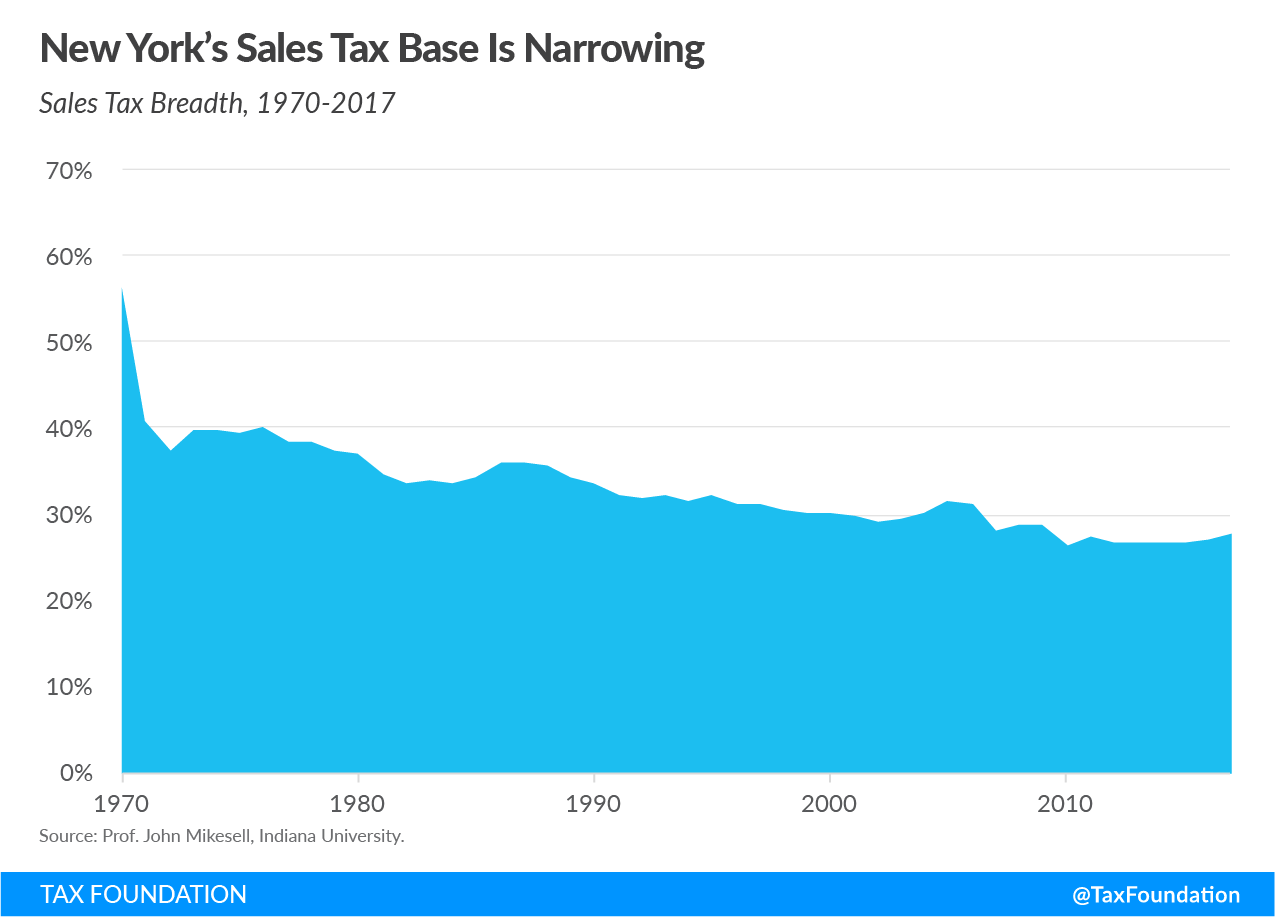

53 rows The SALT deduction also generally benefits states that have relatively large numbers. The limitation on the deductibility of state and local taxes SALT at 10000 was part of the Tax Cuts and Jobs Act back in 2017. 10 2019 402 pm ET.

Over the weekend New York became the first state to create a state and local tax SALT deduction cap workaroundtwo workarounds in fact since New York does nothing on a small scale. The bill passed on Thursday includes some budgetary gymnastics in order to avoid. Learn about New Yorks pass-through entity tax to help you work around it.

An eligible City partnership means any. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here. According to WalletHub when you measure taxes on individual.

This number apparently is an estimate of the amount New Yorkers would now be saving if the SALT deduction had been preserved in combination with all of the other tax cuts featured in the TCJA. Cuomos initial budget proposal in January and it comes at a time when many Democrats are calling on Pres. Yet while the newly adopted budget encourages high.

With the SALT limitation in place New Yorkers who already send 40 billion more in taxes to federal coffers than the state receives in return face the manifestly unfair risk of being taxed twice on the same income Nadler said. Cuomo repeatedly has claimed that the SALT cap is costing New Yorkers up to 15 billion a year in higher federal taxes. Senator Brooks proposes legislation to protect LI from impact of federal tax overhaul.

With Democrats in power those homeowners are. More businesses are taking advantage of a New York law that lets their employees avoid a federal cap on the amount of state and local taxes they can deduct from. Almost all 96 percent of the benef its of SALT cap repeal would go to the top quintile giving an average tax cut of 2640.

Residents of New York take the highest average deduction for state and. Scott is a New York attorney with extensive. The SALT cap essentially resulted in a pretty large tax increase for a lot of families in the suburbs of New York City Mr.

2022-23 New York Issues Draft Regulations That Address Certain Internet Activities Under PL. New York State issues guidance on SALT cap workaround - Mazars - United States. While other states are considering workarounds to the Tax Cut and Jobs Acts TCJA 10000 annual limit on the federal deduction for state and local taxes SALT on individual income tax returns New York became the first state to pass actual legislation.

The New York Department of Taxation and Finance NY DOTF.

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

How Does The Deduction For State And Local Taxes Work Tax Policy Center

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Congress And The Salt Deduction The Cpa Journal

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Why This Tax Provision Puts Democrats In A Tough Place Time

Salt Cap Confounds Doomsayers As Fears Of Exodus Prove Overblown Bloomberg

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

The Salt Tax Deduction Is A Handout To The Rich It Should Be Eliminated Not Expanded

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

The New Jersey Business Alternative Income Tax Nj Bait What You Need To Know Rosenberg Chesnov

Highlights Of The New York State Pass Through Entity Tax Prager Metis

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

/cdn.vox-cdn.com/uploads/chorus_image/image/70105881/1236366936.0.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

What S The New York State Income Tax Rate Credit Karma

New York Enacts Pass Through Entity Tax Election As Salt Deduction Workaround Our Insights Plante Moran